You need money for your one-person business. I haven’t seen this discussed much but how you do this depends on the risk associated with the business and the use of funds. Before we look at that, let’s look at the different types of financing that may be available.

While finance can be a highly complex topic, at the heart of it it’s pretty simple. There are two main kinds of financing - debt and equity.

How you approach funding your business has everything to do with the risk level of the investment. But there’s a couple of dimensions to risk that you need to understand.

Debt: Borrowing the Money You Need

The general idea of debt is simple - someone loans you money and you pay it back… typically with interest.

Security

OK, it’s a little more subtle than that. There’s also the matter of security, that is, what’s on the line if you don’t pay them back. When you mortgage your home, if you don’t pay the mortgage, they can take your home. Your home is the security for the loan. The same with a car loan, you don’t pay, you get a visit from Repo Man.

If you’ve taken my advice and incorporated your business if someone then loans money to the business only the business is on the hook to pay it back. This NEVER happens for new businesses and is unlikely to happen for established solopreneur businesses. Instead, if you borrow money, they will ask for a Personal Guarantee. This means if you don’t pay it back, they can come after any asset you own to get paid back for the amount you borrowed, the interest, and legal fees.

It's important to note that, while lenders holding a personal guarantee have a right to all your stuff, they don’t want it. If you ever become unable to fulfill the terms of a loan, contact the lender before you are in default and try to work something out. Make sure they know that you want to pay it back as soon as you can, but you have some current challenges. Then pay them anything you can each month. If the lender believes you are eventually going to pay back the money, they will almost always work with you. For credit card debt, debt consolidation may be a good option.

Types of Debt

Let’s look at some options for debt funding.

|

Debt Funding Type |

Pros |

Cons |

|

Credit Card |

Easy to get |

Very high interest rates |

|

|

Pay off any time |

|

|

Standard Bank Loan |

Lower interest rates |

Harder to get |

|

|

|

May have a prepayment penalty if you pay off early |

|

Revolving Line of Credit |

Only borrow what you need that month |

Lower credit limits than standard bank loans |

|

|

Lower interest rates than a credit card |

Can be fees associated with keeping the credit line. |

|

|

Pay off any time |

|

|

Friends & Family Loan |

Not a lot of paperwork. Interest rates may be reasonable. |

Holidays may be uncomfortable if you can’t pay it back |

|

SBA Loan |

Low interest rates. |

Slow approval process |

|

|

Can be easier to qualify than a traditional bank loan |

|

Simply put, debt financing obligates you to pay back the amount borrowed with interest.

Equity: Taking on Investors

With one extreme and one possible exception, equity is not generally a way that solopreneur businesses get financed. The reason is that equity investors are buying a piece of the company and their goal in doing so is to produce as much gain as possible on the value of the business.

But solopreneurs are not usually focused on massively growing a business. The decision to become a solopreneur is usually a lifestyle choice, not a business decision. This means that the solopreneur is focused on having the business serve their life goals instead of on growth and profit. This does not excite equity investors, at least not typical venture capitalists or angel investors.

|

Equity Funding Type |

Pros |

Cons |

|

Personal Savings |

Easy to get |

It’s your money! |

|

|

Returns can beat the stock market |

|

|

Friends & Family |

Only other equity option for solopreneurs |

Giving up equity |

|

|

|

Can be ugly with friends & family if it goes bust |

So, what’s the exception for equity investment in solopreneur businesses? It’s your own personal savings.

What I mean is investing your own money in your solopreneur business. Hunter Boyd of Solopreneur Financial has done research and shown that money invested by solopreneurs in their own businesses produces a great return on investment than typical stock market returns. So, investing your own money in your solopreneur business can be the best way to meet the financial needs of the business.

Another possible source of equity funding is Friends & Family but this is not usually a great idea for the same reason that professional equity investors don’t like these deals – incentives are not aligned. But if Uncle Bob wants to give you some money to help you grow your business in exchange for a share of future profits and he understands the risks, what the heck!

So, regardless of who invests equity in your business, they are only entitled to their share of the distributed profits. They do not get paid back like a loan.

Funding a business as a solopreneur can be tough (along with running a business in general!). We encourage you to check out The Solopreneur Success Cycle! It’s an incredible roadmap designed to help you start, run, and grow your company of one and is beneficial for novice and experienced solopreneurs! Be sure to check it out!

Understanding Risks to Funding Your Solopreneur Business

When deciding whether and how to raise funds for your business, it’s important to start by understanding the risk level. This will inform the right way to move forward

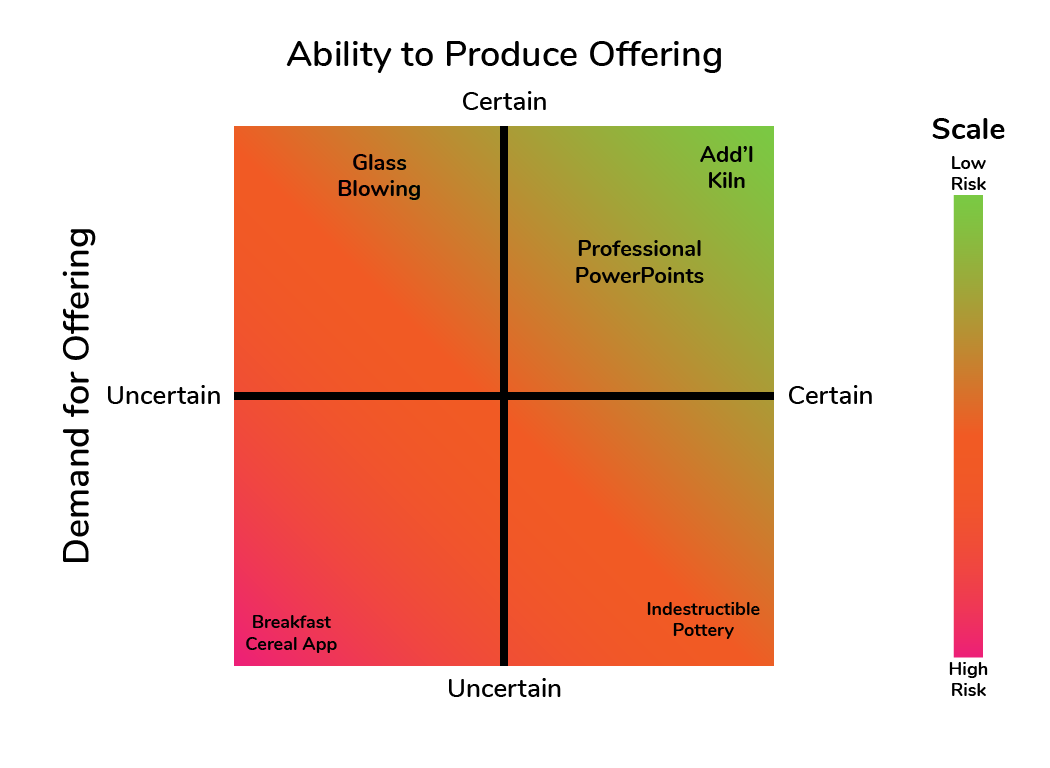

There are 2 major dimensions to risk when investing in starting or expanding a business.

- Your ability to produce the offering

- The existence of customers who want the offering

Either one of these not being certain creates risk. When both are in question, it is extremely risky.

Let’s look at the risk of investing on your business, whether it’s new or existing. Depending on the kind of business you are starting, you may be taking a small risk or a very big risk.

If your business is one where it’s clear that there is plenty of demand, then the risk of finding customers is relatively low. If your ability to produce the product is not in question, then the risk of having something to actually sell is low. On the other end of the spectrum, if demand for your product is not established or your ability to create or deliver the product is not certain, then the risk is very high.

I show this graphically here.

Figure 1: Quadrant analysis of investment risks for solopreneurs

Very Low Risk: Let’s say you have a business making artisan pottery that you sell online. Demand is so high that you can’t keep up because you are limited by the size of your kiln. You want to buy a second kiln so you can double your production. This is very low risk because demand is established, and there’s no real risk that the new kiln won’t work.

Moderate Risk 1: Now instead imagine a business where you are selling pottery and decide to add glass blowing to your offering since you are an expert in that as well. While it sounds reasonable that people who buy artisan pottery would also buy hand-blown glass, it’s not certain. So, this change is moderately risky.

Moderate Risk 2: In this case, you have an idea for a new kind of pottery that looks beautiful but is virtually indestructible. You need to build a special type of kiln to even prove the concept. But if it works, you are sure that your existing customer base will buy the pottery because it will last forever. So, demand is certain but your ability to produce is not clear.

Lower Risk: If you are a graphic designer specializing in creating professional-looking PowerPoint presentations for businesspeople, then demand for your product is not in question; people are always looking for attractive PowerPoint presentations. If you’ve been doing this for 5 years at a company and are looking to go off on your own, it’s clear you’ll be able to produce the product. The only issue is that you don’t have any customers yet. This is a moderately low-risk business to start.

Very High Risk Let’s say you have an idea for an app that uses people’s ratings of breakfast cereals to recommend other cereals that they would like. It’s not clear if the app will successfully recommend cereals they like and it’s not 100% certain that people want an app telling them which cereals to try. This is a high-risk business to start.

Funding in the Context of Risk

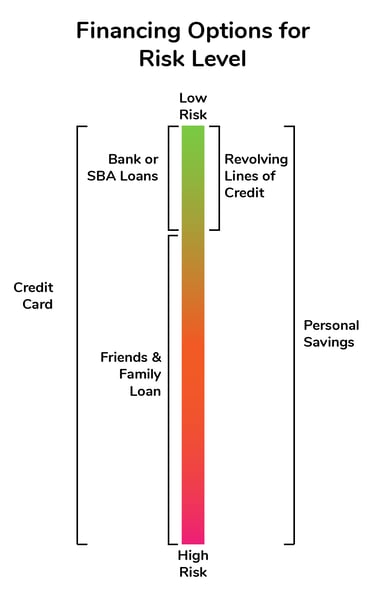

Depending on the risk, certain kinds of funding are most appropriate as shown below.

Low-Risk Investments

Low-Risk Investments

Debt: For very low-risk investments, bank loans, SBA loans, and revolving lines of credit are the best option as the interest rates are low. However, credit cards, while possessing high-interest rates, can be used to obtain funds with almost no paperwork. This can be acceptable for investments that allow the loan to be paid back reasonably quickly.

Equity: Personal savings is another option. This can produce a better return on investment than the same funds sitting in a bank account.

Moderate-Risk Investments

Debt: A Friends and Family loan can make sense for investments with somewhat moderate risk, but as you move to higher risk, this becomes less attractive because the risk of loss can be unacceptably high. Again, credit cards are an option but you’ll have to pay it back.

Equity: An investment from Friends & Family can make sense for moderate-risk investments. But remember, you will be sharing ownership and profits with them, which can be much more expensive than interest in the long run, which is why I do not recommend this approach for low-risk investments. You also want to consider the personal implication if things go poorly. Many people say they understand there is a risk but when the money is lost, they don’t take it well.

High-Risk Investments

As a solopreneur, you’re not going to get investment from angel investors or venture capitalists unless you plan to only stay solo for a short spell (and this blog is not for you).

Debt: The only option for debt financing a high-risk investment is your credit card. Just know you’ll be paying it back one way or another.

Equity: While you can ask Friends & Family to invest in something high-risk, it’s not usually a great idea due to the failure rates of these kinds of investments. Personal savings is usually your best bet for this type of investment.

Conclusion

Because the nature of a solopreneur business is, by definition, not focused exclusively on massive growth, the options for financing are limited and are based on the risk level of the investment.

For getting started, Personal Savings is my favorite, followed by a Friends & Family loan.

Regardless of whether you are starting out or investing in an existing business, be sure to understand the risk level of your investment and proceed appropriately.

THE BUSINESS HELP YOU WANT TO BE DELIVERED TO YOUR INBOX.

Posts by Tag

- Featured (28)

- Focus (10)

- Solopreneur Health and Wellness (10)

- Productivity (9)

- Increase Money, Not Hours (8)

- Marketing for Solopreneurs (8)

- solopreneur success cycle (7)

- Goals (6)

- Independent Contractors (6)

- Inspiration (6)

- Planning Your Business (6)

- Community (3)

- Self-Care (3)

- Success (3)

- storytelling (3)

- Legal (2)

- Motivation (2)

- Relationship Building (2)

- Stress (2)

- Collaboration (1)

- Finance (1)

- Leadership (1)

- Mindfulness (1)

- Niches (1)

- Project Management (1)

- Solopreneur Challenges (1)

- lead generation (1)