4 min read

Is it Time to Raise Your Prices? 6 Things Solopreneurs Should Consider

![]() Joe Rando

:

Nov 4, 2022 8:00:00 AM

Joe Rando

:

Nov 4, 2022 8:00:00 AM

Inflation is here and it will be with us for a while. This means that the costs of almost everything you buy is going up, and that creates challenges. But the good news is that, unless your customers have you locked into long-term contracts with fixed prices, you can raise your prices too.

We often get asked by solopreneurs how to increase income without increasing their hours, and raising prices is one of the "easiest" ways to do that.

However, the prospect of raising prices scares a lot of solopreneurs, including me, but on average, prices go up not down over time and this is a good thing. Shrinking prices is called deflation and though it might sound attractive it absolutely is not!

So, raising prices shouldn’t scare you but there are some things you absolutely need to consider before you do.

What Solopreneurs should consider before raising prices

1. Look for Signs

There are signs that can indicate whether raising prices is a good idea.

The first and most important is whether you are too busy or not. If you can’t keep up with demand, then you should raise your prices regardless of the inflation rate as you are currently leaving money on the table.

Related to this is your close rate. If you close over 80% of the deals you target, you can probably raise prices. Target about 75%.

2. Consider Revenue, not Orders

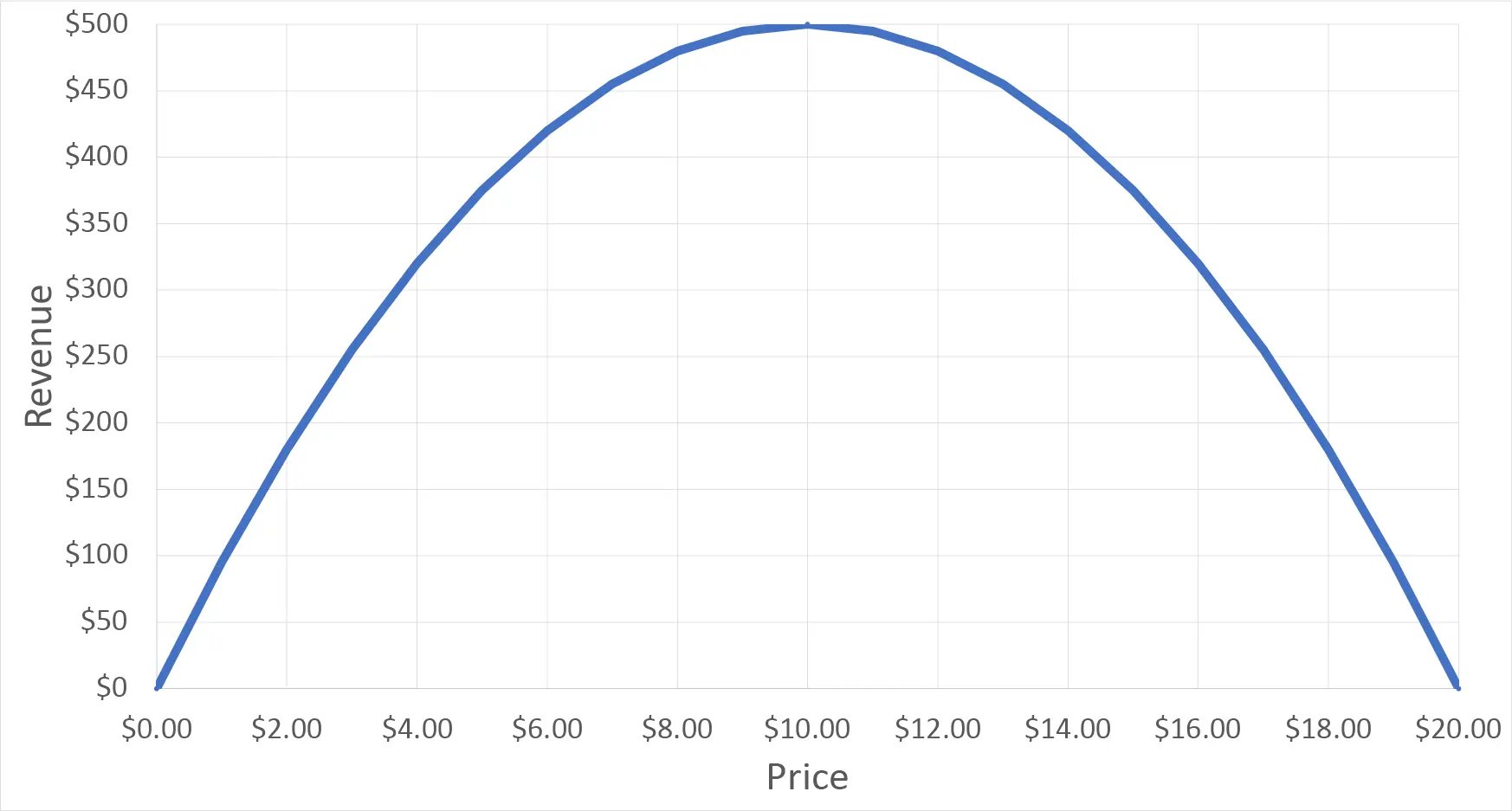

As you raise your prices, you should expect to receive fewer orders for your product or service. But the amount of revenue you will collect per customer will increase. If you plotted out price versus revenue, the resulting curve would look something like this (assuming you’re not selling some type of commodity with a market price like feed corn):

The idea here is that there is a price that maximizes revenue (in this case, $10.00). If you price:

- too low you have lots of customers but collect little revenue

- too high and you lose more customers than you gain via the increase in revenue per customer

What’s the secret to finding that perfect point that maximizes revenue? The answer is making good guesses because there is no way to do this perfectly in the real world.

In fact, even if you did find it you wouldn’t know that you did. But this concept is still important. If you can get close to the max point, you can make more money with less effort.

3. Or Better Yet, Consider Profit, Not Just Revenue

Even better than revenue is profit. If your product has unit costs that decrease with volume, this will impact how much of your revenue you actually keep. Look carefully at your costs at various volumes. If there is a significant decrease in unit cost at some volume, you may want to bias your pricing strategy toward that volume of business.

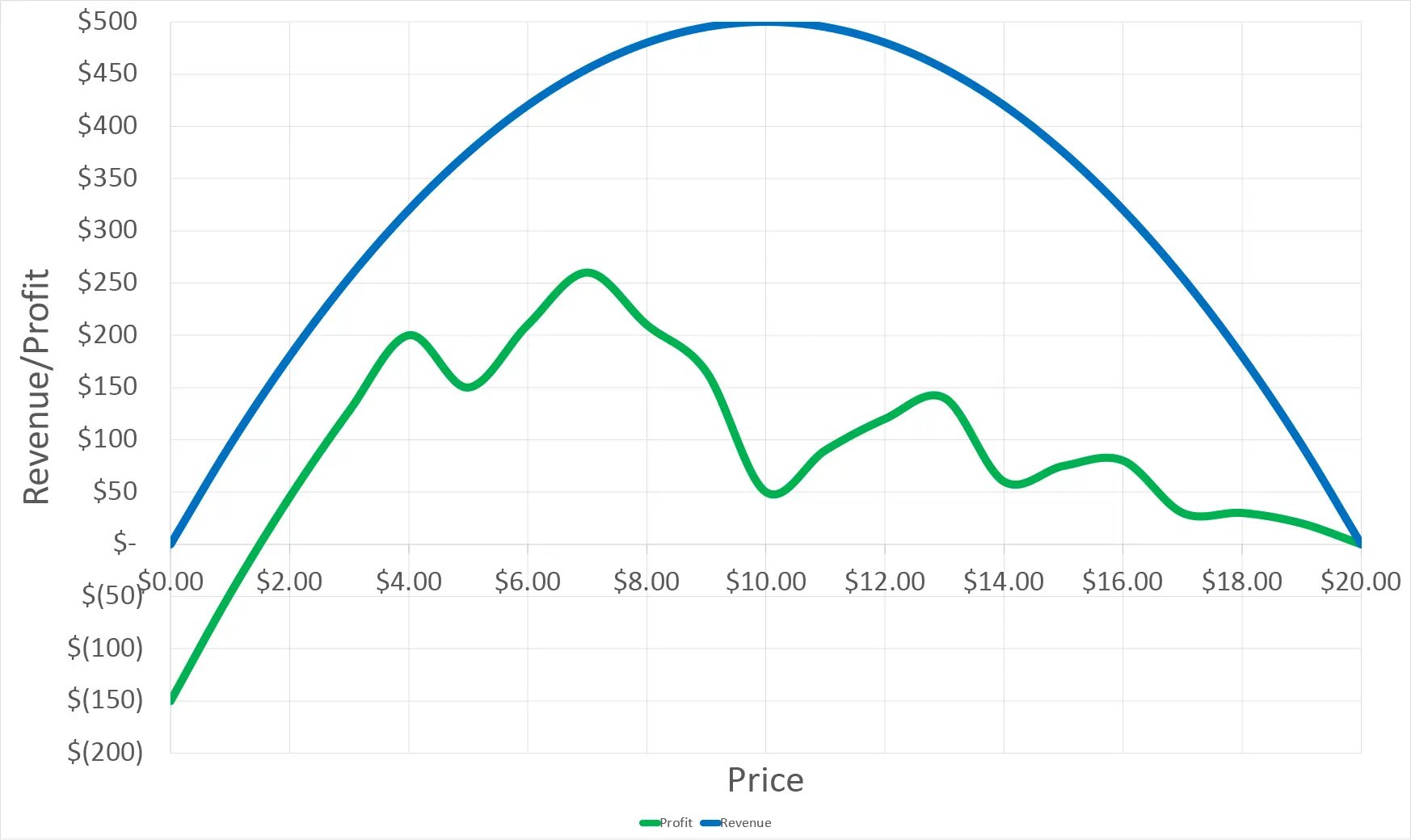

Look at this chart showing both revenue and profit:

You can see that the maximum profit occurs at a lower price than the maximum revenue because the lower unit costs more than make up for the lost revenue. The nice thing about this perspective is that, unlike the revenue curve, you actually have an idea of what your unit costs look like.

If raising your prices (and thereby reducing sales volume) is going to push you into a significantly higher unit cost, then you may not want to raise your prices, and, in fact, lowering them may be a good strategy.

4. Look at it from the Customer’s Perspective

It helps a lot to take your customer’s perspective on this. If your customers spend a small amount on your product or service, a large percentage increase may not be noticed. But if they spend a lot, then it could be a big deal to them. And remember, you put dollars in the bank, not percentages.

A small percent increase of a big-dollar item could really help your bottom line while being viewed as minimal by the customer.

Looking deeper, how much do they spend on you versus the overall expenditure on what they produce?

A big number from your perspective could be a fraction of one percent of their overall production costs. They may barely notice it.

Changing vendors involves costs and hassles, so this may create an unwillingness to switch even when facing a price increase.

Do you have a great working relationship? If so, they may be reluctant to lose that to potentially save a few dollars.

Look at what other challenges they might face if they leave you. I knew of a data supplier that raised prices when no one was raising prices. They had a significant competitor and it seemed to me that they were at risk of losing business to them. But it turned out that the customers used this data to report to Wall Street and switching vendors was going to require a great deal of explaining since the two data sets did not agree on all the numbers being supplied. This would be a huge undertaking and none of the customers said much about the price increase.

The reality is that the response to a price increase is going to be based on the customer’s perception of the increase in the context of THEIR business, not yours.

5. Be Transparent

It can really help to explain to your customers why you are raising prices, that is assuming you have a good reason. Telling them about your own cost increases can truly help because they feel that you have good reason and are taking the time to be straight with them. Also, they likely expect that your competitors are facing the same challenges and will have to do the same.

By giving good and understandable reasons why you are raising prices, you make it less likely that the customer will balk at the increase.

6. Be Nice to Your Exiting Loyal Customers

Grandfathering in existing customers to the current pricing before raising prices can be a good way to thread the needle. They will feel appreciated and like they are getting a good deal. New customers don’t need to know that someone else is getting a better deal. However, it may be a good idea to put a time limit on this price lock so it isn’t perceived as a permanent price lock.

By rewarding your loyal customers in the context of a price increase, you can actually increase their loyalty and reduce the risk of them leaving you.

Making the decision to raise prices almost always involves some risk, but so does NOT raising prices, particularly in inflationary periods where your real profit is being eroded. Even during non-inflationary periods, there are times when price increases are appropriate and can increase your income or decrease your working hours. Be careful in this process but don’t be timid.

Like getting the inside scoop on how to be a successful solopreneur? Join our free community of solopreneurs to learn a thing or two, get your questions answered, share knowledge with others, and build your network.

THE BUSINESS HELP YOU WANT TO BE DELIVERED TO YOUR INBOX.

Posts by Tag

- Featured (28)

- Focus (10)

- Solopreneur Health and Wellness (10)

- Marketing for Solopreneurs (9)

- Productivity (9)

- Increase Money, Not Hours (8)

- solopreneur success cycle (7)

- Goals (6)

- Independent Contractors (6)

- Inspiration (6)

- Planning Your Business (6)

- Community (3)

- Self-Care (3)

- Success (3)

- storytelling (3)

- Legal (2)

- Motivation (2)

- Relationship Building (2)

- Stress (2)

- lead generation (2)

- Collaboration (1)

- Finance (1)

- Leadership (1)

- Mindfulness (1)

- Niches (1)

- Project Management (1)

- Solopreneur Challenges (1)